How a Probate Attorney Supports Beneficiaries in Los Angeles

A probate attorney provides essential guidance to beneficiaries navigating the complex process of estate administration. When a loved one passes, managing their estate can involve a variety of tasks, including asset distribution, debt settlement, and compliance with probate laws. Probate attorneys in Los Angeles help ensure that these responsibilities are carried out accurately and fairly, while also clarifying legal obligations for beneficiaries. Their involvement reduces the risk of errors or disputes, allowing families to focus on understanding the process and completing necessary steps efficiently. Legal guidance provides structure and clarity during a period that can be both emotional and legally challenging. Explaining Probate Procedures Handling Disputes Among Beneficiaries Managing Trust Administration Documentation and Legal Oversight Local Professional in Los Angeles Providing Ongoing Support for Beneficiaries Ensuring Fair and Orderly Administration Conclusion Member Spotlight Los Angeles Probate Attorneys Get Map Direction: - https://maps.app.goo.gl/BQMSCWPSwZyUi8LA8 A probate attorney assists beneficiaries with legal processes, trust administration, and dispute resolution during estate management. In Los Angeles, probate attorneys provide clarity, guidance, and structure, helping families navigate the probate process efficiently while maintaining fairness and transparency throughout.

Probate begins when a will is filed with the court to confirm its validity and establish a plan for estate administration. The process includes valuing assets, notifying beneficiaries, paying debts, and distributing property. A probate attorney guides clients through these steps, helping them understand procedural requirements, deadlines, and responsibilities. They also assist in preparing accurate documentation, ensuring compliance with California probate law, and clarifying any complex legal terms. By providing clear explanations and ongoing support, probate attorneys reduce confusion and help beneficiaries feel more confident while navigating each stage of the estate administration process.

Conflicts among heirs or beneficiaries are common when managing an estate, particularly regarding the interpretation of a will, asset distribution, or trust administration. Probate attorneys represent beneficiaries and provide guidance on resolving these disputes efficiently and fairly. They may assist in negotiations, mediation, or court proceedings to address disagreements while protecting clients’ rights. Legal support helps reduce tension among family members and ensures that disagreements do not disrupt the administration process. By managing disputes professionally, probate attorneys maintain fairness, support equitable outcomes, and help beneficiaries navigate challenging circumstances while keeping the estate administration process on track.

Many estates include trusts to distribute assets over time or under specific conditions. Trust administration involves reviewing trust documents, overseeing asset distribution, and addressing any conflicts between trustees and beneficiaries. Probate attorneys provide guidance to trustees, ensure legal compliance, and assist beneficiaries in understanding the trust’s provisions. They also help prevent mismanagement or misunderstandings by maintaining detailed records and offering structured guidance. By overseeing these responsibilities, probate attorneys ensure that trusts are managed according to the intentions of the deceased, provide clarity to beneficiaries, and create a transparent process that minimizes potential conflicts while promoting fair and consistent administration.

Accurate documentation is critical for effective probate and estate administration. Probate attorneys assist with compiling asset inventories, filing court forms, preparing creditor notices, and maintaining records of all distributions. Proper documentation ensures transparency, protects the estate, and minimizes the potential for disputes or delays. Attorneys also monitor deadlines, filing requirements, and compliance with California probate law. By providing structured oversight and maintaining detailed records, probate attorneys create a clear, organized process that supports beneficiaries and helps the estate proceed efficiently. Documentation also provides evidence of legal compliance, which can prevent challenges from arising during or after the probate process.

Probate procedures vary by jurisdiction, and Los Angeles has specific legal requirements that can affect estate administration. Probate attorneys familiar with local court rules and filing procedures can streamline the process, ensuring that deadlines are met, filings are correct, and notifications reach all beneficiaries. Local knowledge helps attorneys address disputes, trust issues, or compliance concerns efficiently. Beneficiaries benefit from guidance tailored to regional practices, including an understanding of court expectations and local probate timelines. By providing insight into the Los Angeles legal system, probate attorneys reduce potential challenges and facilitate a smooth and orderly administration process for all parties involved.

The probate process can be stressful, particularly for families managing emotional, administrative, and legal responsibilities simultaneously. Probate attorneys provide consistent support by clarifying roles, explaining legal steps, and offering guidance during disputes or confusion. They maintain transparency and communication, keeping beneficiaries informed about progress, timelines, and decisions. This support reduces anxiety and helps beneficiaries make informed decisions while ensuring compliance with legal obligations. Attorneys create a structured environment that fosters cooperation, clarity, and fairness, allowing families to focus on personal matters rather than navigating complex legal processes on their own.

A key role of probate attorneys is maintaining fairness and order throughout the estate administration process. They oversee documentation, dispute resolution, trust management, and communication with beneficiaries and the court. Their guidance ensures that assets are distributed according to the deceased’s wishes while following legal requirements. By providing consistent oversight, probate attorneys prevent errors, delays, and conflicts, creating a transparent and organized process. Beneficiaries are able to navigate the estate with confidence, knowing that professional legal guidance is ensuring equitable treatment, legal compliance, and clarity at each step of administration.

A probate attorney Los Angeles provides vital support for beneficiaries, assisting with probate procedures, trust administration, dispute resolution, and legal compliance. By offering guidance throughout the estate administration process, probate attorneys ensure fairness, clarity, and order. Their involvement reduces stress, prevents errors, and helps beneficiaries understand their rights and responsibilities. With professional oversight, families can navigate the complexities of estate administration while ensuring that the deceased’s intentions are honored and legal requirements are fully met.

445 S Figueroa St Suite 3100,

Los Angeles, CA 90071

(424) 402–1228

https://www.losangelesprobateattorneys.com/

Estate Administration and Judicial Review in California Probate

• Overview of Court Supervised Estate Handling

The phrase probate attorney Los Angeles is often referenced when discussing how estates move through court supervised administration in California. Probate provides a formal legal structure that confirms authority, evaluates documents, and oversees asset distribution under established statutes. This process promotes clarity for heirs, beneficiaries, and creditors.

• Purpose of Probate Administration

Probate administration exists to ensure that estate matters are resolved in an orderly and transparent manner. When assets remain solely in an individual’s name, court involvement helps address ownership, obligations, and lawful transfer. The process balances procedural requirements with judicial oversight to maintain consistency.

• Initiating a Probate Case

A probate case begins with the filing of a petition that outlines key information about the deceased person and the estate. Notices are issued to interested parties to provide awareness and opportunity for participation. These initial steps establish the court’s authority over estate administration.

• Appointment and Duties of Fiduciaries

Once the court appoints a personal representative, fiduciary responsibilities begin. These duties include safeguarding property, organizing records, and communicating with the court. Accurate documentation and timely filings support court review throughout administration.

• Asset Identification and Valuation

Identifying estate assets forms the foundation of probate. This includes real property, financial accounts, and personal items subject to court jurisdiction. Inventories and valuations provide transparency and assist the court in evaluating subsequent actions related to claims and distribution.

• Addressing Claims and Estate Obligations

Probate includes a structured method for addressing outstanding obligations. Creditors receive notice and may submit claims within statutory periods. The court reviews how these claims are evaluated and resolved, ensuring adherence to legal standards.

• Resolving Disputes Within Probate

Disagreements may arise over wills, asset valuation, or administrative conduct. Probate litigation allows these issues to be addressed through hearings and legal review. Courts rely on statutory guidance to evaluate evidence and reach determinations that maintain procedural order.

• Final Review and Estate Closure

The final phase of probate involves submitting an accounting for court approval. After authorization, assets are distributed according to governing documents or intestacy rules. The estate is then formally closed. In discussions of these concluding steps, references to a probate attorney Los Angeles often relate to navigating procedural requirements within the local court system.

Member Spotlight

Los Angeles Probate Attorneys

445 S Figueroa St Suite 3100,Los Angeles, CA 90071

(424) 402–1228

https://www.losangelesprobateattorneys.com/

Get Map Direction: -

https://maps.app.goo.gl/BQMSCWPSwZyUi8LA8

The keyword probate attorney Los Angeles appears in informational contexts related to court supervised estate administration. Its usage reflects geographic relevance and procedural understanding rather than promotional claims. This term aligns with topics such as petitions, fiduciary duties, and judicial review that define probate proceedings. By focusing on lawful process and compliance, the keyword supports clear explanations of how estates are administered within Los Angeles probate courts. Its careful placement reinforces clarity and maintains an informative tone.

Understanding the Tax Implications of Inheriting Property in California

Working with a probate attorney helps beneficiaries understand the complex tax considerations that come with receiving inherited property. When someone passes away and leaves assets to heirs, various tax obligations may arise that affect both the estate and the individuals receiving property. Understanding these tax implications allows beneficiaries to make informed decisions about their inheritance and avoid unexpected financial burdens.

California's tax landscape differs significantly from many other states, creating unique considerations for estate settlement. While some tax obligations apply at the federal level, California has its own rules that affect how inherited property is treated. Beneficiaries need to understand both state and federal requirements to properly manage their tax responsibilities.

Federal Estate Tax Considerations

The federal government imposes estate tax on large estates, though most estates fall below the threshold requiring payment. The exemption amount changes periodically based on legislation, and estates valued below this threshold owe no federal estate tax. For estates exceeding the exemption, tax rates can be substantial, potentially reducing the amount available for distribution to beneficiaries.

Estate tax is paid by the estate itself before distributions occur, not by individual beneficiaries. However, the tax can significantly reduce inheritance amounts, particularly for beneficiaries of high-value estates. Understanding whether an estate faces federal estate tax liability helps beneficiaries set realistic expectations about their inheritance.

California's Absence of State Estate Tax

Unlike some states, California does not impose a state-level estate tax or inheritance tax. This absence simplifies tax planning for California residents and means that beneficiaries generally face fewer tax obligations than heirs in states with additional estate or inheritance taxes. The lack of state estate tax represents a significant advantage for California estates and beneficiaries.

Income Tax Basis Step-Up Rules

One of the most valuable tax benefits for beneficiaries involves the step-up in basis rule. When someone inherits property, the tax basis generally adjusts to the fair market value at the date of death. This adjustment can provide substantial tax savings if the beneficiary later sells the property.

For example, if the deceased purchased real estate decades ago for a small amount and it appreciated significantly, the beneficiary receives the property with a basis equal to its current value rather than the original purchase price. If the beneficiary sells shortly after inheriting, they may owe little or no capital gains tax because their basis closely matches the sale price.

Community Property Considerations

California's community property laws create additional tax benefits for surviving spouses. When one spouse dies, community property receives a full step-up in basis for both halves of the property, not just the deceased spouse's half. This complete basis adjustment can result in substantial tax savings if the surviving spouse later sells community property.

Income Tax on Estate Assets

While inherited property itself is not considered taxable income to beneficiaries, income generated by estate assets during the administration period may be taxable. Interest earned on bank accounts, dividends from investments, and rental income from real property all create taxable income that must be reported.

The estate files its own income tax returns for income earned during administration. Once property is distributed to beneficiaries, they become responsible for reporting and paying tax on income generated by their inherited assets. Understanding this transition helps beneficiaries prepare for their tax obligations.

Retirement Account Inheritance

Inheriting retirement accounts like IRAs creates specific tax obligations. Unlike other inherited property, retirement accounts generally do not receive a step-up in basis. Beneficiaries must typically withdraw funds from inherited retirement accounts over time and pay income tax on distributions.

Rules for inherited retirement accounts changed recently, requiring most non-spouse beneficiaries to withdraw all funds within ten years of the original account owner's death. These required distributions create tax obligations that beneficiaries must plan for carefully. Spouses who inherit retirement accounts have more flexible options, including treating the account as their own.

Property Tax Reassessment Issues

California's Proposition 13 limits property tax increases while the same owner holds property. However, when property transfers at death, reassessment may occur, potentially increasing property taxes significantly. Some parent-to-child and grandparent-to-grandchild transfers can avoid reassessment under certain circumstances, preserving lower property tax rates.

Recent changes to California law limited these reassessment exclusions, making them available only for primary residences up to a certain value and limited amounts of other property. Beneficiaries inheriting real estate should understand whether reassessment will occur and how it might affect their ongoing costs of ownership.

Capital Gains on Inherited Property Sales

When beneficiaries sell inherited property, they may owe capital gains tax on any appreciation above their stepped-up basis. The holding period for inherited property is automatically considered long-term, regardless of how soon after inheriting the beneficiary sells. Long-term capital gains generally receive more favorable tax treatment than short-term gains.

Beneficiaries should carefully track their basis in inherited property and maintain documentation supporting the fair market value at the date of death. Proper records ensure accurate tax reporting when property is eventually sold.

Estate Income Tax Returns

Estates must file income tax returns for any year they earn more than minimal income. These returns report income earned by estate assets during the administration period. Estate income tax rates can be quite high, making tax planning during administration important for preserving estate value.

Gift Tax Considerations

Sometimes beneficiaries consider gifting portions of their inheritance to others. Federal gift tax rules limit how much someone can give away annually without tax consequences. While most gifts fall within the annual exclusion amount, larger gifts may require filing gift tax returns and could reduce the lifetime gift and estate tax exemption.

Foreign Asset Reporting

If the deceased owned foreign financial accounts or assets, additional reporting requirements may apply. Beneficiaries inheriting foreign assets must understand their obligations to report these holdings to the IRS and comply with foreign account reporting rules.

Charitable Bequests and Tax Benefits

When estates include charitable bequests, those gifts can reduce estate tax liability because charitable donations are deductible from the taxable estate. Beneficiaries do not receive direct tax benefits from the estate's charitable giving, but charitable bequests can reduce overall estate tax, preserving more assets for distribution.

Documentation and Record Keeping

Proper documentation is essential for managing tax obligations related to inherited property. Beneficiaries should maintain records showing property values at the date of death, any appraisals conducted, and all transactions involving inherited assets. These records support tax return preparation and provide evidence if the IRS questions reported values.

Planning for Future Tax Obligations

Beneficiaries should consider future tax implications when deciding whether to keep or sell inherited property. Continuing to hold real estate generates ongoing property tax obligations and may create maintenance costs. Investment accounts generate taxable income that affects annual tax returns. Understanding these ongoing obligations helps beneficiaries make informed decisions about managing their inheritance.

Consulting a probate attorney provides beneficiaries with guidance on tax matters affecting their inheritance and helps ensure compliance with all applicable tax laws and reporting requirements.

Member Spotlight

Los Angeles Probate Attorneys

445 S Figueroa St Suite 3100,

Los Angeles, CA 90071

(424) 402-1228

https://www.losangelesprobateattorneys.com/

Get Map Direction: -

https://maps.app.goo.gl/BQMSCWPSwZyUi8LA8

A probate attorney can help beneficiaries understand how tax laws affect their inheritance and coordinate with tax professionals to ensure proper handling of all tax obligations. These legal professionals understand California's tax landscape and can explain how federal and state rules apply to inherited property. Proper legal guidance helps beneficiaries navigate complex tax issues and make informed decisions about managing their inheritance while minimizing tax burdens.

Understanding the Importance of a Probate Lawyer in Los Angeles Estates

Introduction

Managing an estate can be complicated, especially when it involves multiple heirs and valuable assets. A probate lawyer helps families understand the legal requirements, providing guidance on how to navigate estate matters effectively. Knowing when to seek a probate lawyer can prevent confusion and ensure a smoother administration process.

Probate Process Overview

Probate involves validating a will, identifying beneficiaries, paying debts, and distributing assets. Without clear understanding, families may face delays or legal issues. A probate lawyer provides explanations of each step, helping ensure that estate administration proceeds in accordance with California law.

Handling Potential Disputes

Disagreements can arise if beneficiaries feel that assets are not distributed fairly or if there is uncertainty about the intentions of the deceased. A probate lawyer Los Angeles helps manage these situations by clarifying legal rights and providing guidance on available options. Their involvement can reduce misunderstandings and promote cooperation among heirs.

Guiding Families Through Court Requirements

Probate involves strict deadlines, documentation, and communication with the court. Missing a filing or misunderstanding a procedural requirement can create delays or legal complications. A probate lawyer provides support by ensuring that all obligations are met, paperwork is completed correctly, and deadlines are observed.

Benefits of Professional Legal Guidance

Having a probate lawyer can reduce stress during a challenging time. Families can focus on personal and emotional matters while knowing that legal procedures are handled properly. Clear guidance ensures that estate matters comply with California laws, helping prevent disputes and unnecessary delays.

Supporting Transparent Estate Administration

A probate lawyer ensures transparency in asset management, creditor payments, and distribution of property. By explaining each step clearly and objectively, they help maintain trust among family members and reduce the risk of conflicts. This approach contributes to a smoother probate process overall.

Member Spotlight

Los Angeles Probate Attorneys

445 S Figueroa St Suite 3100,

Los Angeles, CA 90071

(424) 402-1228

https://www.losangelesprobateattorneys.com/

Get Map Direction:-

https://maps.app.goo.gl/BQMSCWPSwZyUi8LA8

Conclusion

Engaging a probate lawyer in Los Angeles ensures that estate matters are managed efficiently, fairly, and according to legal requirements. Their guidance provides clarity, reduces stress, and helps families navigate complex probate procedures with confidence. Legal support plays a crucial role in maintaining order and resolving potential conflicts during estate administration.

Navigating the Role of a Probate Attorney in Managing Beneficiary Expectations

Understanding Beneficiary Dynamics in Probate

The probate process often involves multiple stakeholders, each with unique expectations about estate outcomes. Beneficiaries, ranging from immediate family to distant relatives, anticipate timely and equitable asset distributions. A probate attorney facilitates these transitions, serving as a neutral guide to clarify legal pathways and manage communications. By addressing concerns early, they help align expectations with the realities of court procedures and statutory timelines, fostering smoother resolutions during emotionally charged times.

Core Functions in Probate Administration

Probate administration requires meticulous coordination to fulfill the decedent’s wishes while adhering to legal standards. This includes validating wills, identifying assets, and resolving outstanding debts before distributions. A probate lawyer ensures that beneficiaries receive clear updates on progress, such as when appraisals or creditor notices are completed. They also prepare detailed accountings for court review, which outline all financial transactions, ensuring transparency. This process mitigates misunderstandings, particularly when estates involve complex assets like investment portfolios or family businesses.

Handling Disputes Through Probate Litigation

Disputes among beneficiaries often arise from differing interpretations of estate plans or perceived inequities. Probate litigation addresses these conflicts, whether they involve contesting a will’s validity or questioning an executor’s actions. A probate litigation attorney represents parties in court, advocating for fair resolutions while presenting evidence like correspondence or financial records. Mediation sessions, often encouraged by courts, provide opportunities to settle disputes without prolonged trials, preserving familial relationships and expediting estate closures.

The Role of Trust Administration in Beneficiary Support

Trust administration offers an alternative to probate for assets held in trusts, allowing for direct distributions to beneficiaries. This process involves trustees managing investments, filing tax documents, and allocating funds per trust terms. A probate attorney may advise on trust-related matters, ensuring compliance with fiduciary duties. When conflicts emerge, such as disagreements over distribution schedules, trusts litigation resolves issues, with legal counsel clarifying obligations to maintain trust integrity and beneficiary confidence.

Los Angeles-Specific Challenges in Beneficiary Management

In urban centers like Los Angeles, beneficiary expectations are shaped by diverse cultural backgrounds and high-value estates. A probate attorney Los Angeles navigates these nuances, addressing issues like multi-jurisdictional assets or community property laws that impact spousal shares. Local courts often face heavy caseloads, requiring proactive filings to avoid delays. Legal professionals also coordinate with real estate professionals to manage property transfers, ensuring beneficiaries receive clear title to inherited homes or commercial holdings.

Strategies for Effective Communication

Clear communication is pivotal in managing expectations. Regular updates via meetings or written reports keep beneficiaries informed about timelines and potential hurdles, such as tax settlements. Counsel may also facilitate family discussions to address concerns proactively, reducing the likelihood of disputes. Providing access to general probate resources, like state bar publications, empowers beneficiaries to understand their roles and rights within the process.

Member Spotlight

Los Angeles Probate Attorneys

445 S Figueroa St Suite 3100,

Los Angeles, CA 90071

(424) 402-1228

https://www.losangelesprobateattorneys.com/

Get Map Direction:-

https://maps.app.goo.gl/BQMSCWPSwZyUi8LA8

At Los Angeles Probate Attorney, our skilled Probate Lawyer team is dedicated to resolving complex estate disputes with professionalism and care. We specialize in probate litigation, handling will contests, executor conflicts, and asset distribution disputes. Our attorneys conduct detailed investigations, compile strong evidence, and pursue fair outcomes through mediation or courtroom representation. With a client-focused approach, we offer compassionate guidance and clear communication, helping beneficiaries navigate probate litigation with confidence and peace of mind.

Common Issues in Trust Litigation

What is Trust Litigation?

Trust litigation arises when disputes occur over the management or distribution of a trust’s assets. Unlike probate administration, which involves court oversight, trusts are typically managed privately, but conflicts can still lead to legal proceedings. In Los Angeles, where trusts often hold valuable real estate or investments, these disputes can be complex. A probate litigation attorney represents beneficiaries or trustees in court, working to resolve issues such as mismanagement or breaches of fiduciary duty. Trust litigation ensures that the trust creator’s intentions are upheld while protecting the rights of all parties.

Causes of Trust Disputes

Disputes in trust litigation often stem from disagreements over how the trustee is managing assets or distributing funds. Beneficiaries may claim the trustee is acting unfairly, favoring one party over another, or failing to follow the trust’s terms. Other issues include allegations of fraud or challenges to the trust’s validity. A probate attorney can help investigate these claims, gathering evidence to support the case. In California, where trusts are a popular estate planning tool, these disputes require careful navigation of state laws to achieve a fair resolution.

The Role of the Court in Trust Litigation

When trust disputes escalate, the probate court may intervene to review the trustee’s actions or the trust’s terms. The court can order the trustee to provide an accounting of assets or remove them if they are found to have breached their duties. A probate lawyer Los Angeles assists clients in preparing for court, presenting evidence, and advocating for their interests. The court process can be lengthy, especially in Los Angeles, where high-value trusts are common, and legal representation is essential to navigating these proceedings effectively.

Resolving Trust Disputes Without Litigation

Many trust disputes can be resolved through mediation or negotiation, avoiding the time and cost of a court trial. A probate attorney Los Angeles can guide these discussions, helping parties find common ground while preserving relationships. Mediation is particularly useful in family trusts, where emotional dynamics may complicate matters. If disputes cannot be resolved amicably, litigation becomes necessary to ensure the trust is administered according to its terms and California law.

The Trustee’s Fiduciary Duties

Trustees have a legal obligation to act in the finest interests of the trust and its beneficiaries. This includes managing assets prudently, following the trust’s instructions, and maintaining transparency with beneficiaries. Failure to meet these duties can lead to trust litigation, with beneficiaries seeking remedies for losses. A probate lawyer can advise trustees on their responsibilities, helping them avoid disputes. In Los Angeles, where trusts often involve complex assets, understanding these duties is critical to successful trust administration.

Preventing Trust Litigation

Clear and detailed trust documents can reduce the risk of disputes. Working with a probate litigation attorney during trust creation ensures the document is legally sound and unambiguous. Regular communication between trustees and beneficiaries can also prevent misunderstandings that lead to conflicts. In Los Angeles, where trusts are a key part of estate planning, proactive measures can save families time and stress. By addressing potential issues early and seeking legal guidance, individuals can ensure their trusts function as intended, protecting their legacy for future generations.

Member Spotlight

Los Angeles Probate Attorneys

445 S Figueroa St Suite 3100,

Los Angeles, CA 90071

(424) 402-1228

https://www.losangelesprobateattorneys.com/

Get Map Direction: -

https://maps.app.goo.gl/BQMSCWPSwZyUi8LA8

Los Angeles Probate Attorneys is committed to resolving estate disputes with our Probate Lawyer team. We focus on probate litigation, addressing will contests, executor disputes, and asset distribution conflicts. Our attorneys investigate claims, gather evidence, and advocate for fair outcomes, whether through mediation or court. With a client-centered approach, we provide compassionate support, helping beneficiaries navigate probate litigation challenges with clarity and resolve.

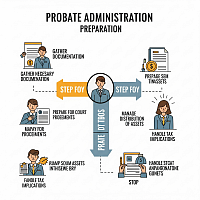

How to Prepare for Probate Administration

Understanding Probate Administration

Probate administration is the legal process of settling an estate after someone passes away. It involves validating a will, identifying assets, paying debts, and distributing property to beneficiaries. A probate attorney guides families through this process, ensuring all legal requirements are met. In Los Angeles, CA, United States, a probate attorney Los Angeles navigates California’s probate laws, helping families manage the process efficiently. Preparation is key to ensuring probate administration proceeds smoothly without unnecessary delays, allowing families to focus on honoring the deceased’s wishes.

Steps to Take Before Probate Begins

Before probate begins, families can take steps to prepare. Gathering important documents, such as the will, financial records, and asset lists, is a critical first step. A probate lawyer can assist in organizing these documents and filing the necessary petitions with the court. They also help identify all assets, including property and accounts, to ensure nothing is overlooked. A probate lawyer Los Angeles ensures compliance with local regulations, streamlining the initial stages of probate administration and setting the stage for an efficient process.

Addressing Potential Disputes

Disputes can arise during probate, particularly if beneficiaries disagree on the will’s terms. A probate litigation attorney can help resolve these conflicts, either through mediation or court proceedings. For example, if a beneficiary questions the validity of a will, legal representation is essential to protect their rights. A probate attorney Los Angeles can investigate claims and present evidence to ensure fair outcomes, preventing disputes from derailing the probate process. Their role helps maintain fairness and clarity throughout the proceedings.

The Role of Trust Administration

Trust administration can simplify estate distribution by avoiding probate. A probate attorney assists trustees in managing trust assets, ensuring compliance with the trust’s terms. This includes notifying beneficiaries, filing taxes, and distributing assets as outlined. In Los Angeles, CA, United States, a probate lawyer Los Angeles ensures that trust administration adheres to local laws, providing an efficient alternative to probate for many estates. This approach can save time and reduce the public exposure of the estate’s details.

Trusts Litigation and Its Impact

If disputes arise during trust administration, trusts litigation may be necessary. Issues like trustee mismanagement or disagreements over distributions can lead to legal challenges. A probate litigation attorney represents clients in these cases, ensuring the trust is administered correctly. A probate lawyer Los Angeles reviews trust documents and advocates for beneficiaries, helping to resolve disputes in line with California’s legal standards. Their involvement ensures that the trust’s purpose is upheld and beneficiaries’ rights are protected.

Why Preparation Matters

Proper preparation can prevent complications during probate or trust administration. A probate attorney can help families organize documents and plan ahead to minimize delays. In Los Angeles, CA, United States, a probate attorney Los Angeles provides guidance on local requirements, ensuring compliance with state laws. Their support helps families navigate the process with confidence, reducing stress during a challenging time. Preparation also ensures that the deceased’s intentions are carried out accurately and efficiently.

Tips for Effective Estate Planning

Creating a clear will or trust is essential for simplifying probate or trust administration. A probate lawyer can draft these documents to reflect the individual’s wishes and comply with legal standards. Regular updates to estate plans can prevent issues caused by outdated information. For those in Los Angeles, CA, United States, consulting a probate lawyer Los Angeles early can ensure a smoother process for beneficiaries, minimizing the risk of disputes and ensuring a clear path for asset distribution.

Member Spotlight

Los Angeles Probate Attorneys

445 S Figueroa St Suite 3100,

Los Angeles, CA 90071

(424) 402-1228

https://www.losangelesprobateattorneys.com/

Get Map Direction: -

https://maps.app.goo.gl/BQMSCWPSwZyUi8LA8

Los Angeles Probate Attorneys is committed to resolving estate disputes with our Probate Lawyer team. We focus on probate litigation, addressing will contests, executor disputes, and asset distribution conflicts. Our attorneys investigate claims, gather evidence, and advocate for fair outcomes, whether through mediation or court. With a client-centered approach, we provide compassionate support, helping beneficiaries navigate probate litigation challenges with clarity and resolve.

Common Misconceptions About Probate Litigation

Probate Litigation can be a complex and misunderstood aspect of estate administration, often leading to confusion among beneficiaries. Addressing common misconceptions can help families approach these disputes with clarity and confidence. A Probate Litigation Attorney plays a key role in guiding clients through these challenges.

Litigation Always Involves Court: Many assume that Probate Litigation always requires lengthy court battles. However, a Probate Attorney can often resolve disputes through mediation or negotiation, saving time and reducing stress.

Only Large Estates Face Disputes: Smaller estates can also face Probate Litigation, particularly when beneficiaries disagree over asset distribution. A Probate Lawyer Los Angeles can help resolve these conflicts, regardless of the estate’s size.

Litigation Is Always Contentious: While disputes can be emotional, a Probate Attorney Los Angeles can facilitate constructive dialogue, helping parties reach agreements without escalating tensions.

Probate Litigation Is Only About Wills: Disputes can also arise over trusts or executor actions. A Probate Litigation Attorney can address issues related to Trusts Litigation, ensuring fair resolutions.

Litigation Delays the Process Indefinitely: While disputes can extend probate, a Probate Lawyer can streamline the process by focusing on efficient resolution strategies.

Any Attorney Can Handle Probate Litigation: Not all attorneys have the specific knowledge required for Probate Litigation. A Probate Attorney Los Angeles with experience in this field can provide tailored guidance to navigate complex disputes.

Understanding these misconceptions can help beneficiaries approach Probate Litigation with realistic expectations. Legal professionals provide critical support, ensuring disputes are resolved fairly and in accordance with the law.

Member Spotlight

Los Angeles Probate Attorneys

445 S Figueroa St Suite 3100,

Los Angeles, CA 90071

(424) 402-1228

https://www.losangelesprobateattorneys.com/

Get Map Direction: -

https://maps.app.goo.gl/BQMSCWPSwZyUi8LA8

Los Angeles Probate Attorneys is committed to resolving estate disputes with our Probate Lawyer team. We focus on probate litigation, addressing will contests, executor disputes, and asset distribution conflicts. Our attorneys investigate claims, gather evidence, and advocate for fair outcomes, whether through mediation or court. With a client-centered approach, we provide compassionate support, helping beneficiaries navigate probate litigation challenges with clarity and resolve.